FRC; Diversifying Financial Reporting, Debuting Islamic Finance

BY ABUBAKAR YUSUF

The Financial Reporting Council, FRC as part of it’s transformation agenda under the Renewed Hope Agenda, RHA of President Bola Ahmed Tinubu’s administration has introduced series of programs as well diversified it’s activities in recent times.

This among many others included the introduction and integration of the robust Islamic Finance Services, IFS , known as “Islamic Banking “into Nigeria’s financial reporting framework by introducing standards issued by the Accounting Auditing Organization for Islamic Financiall Institutions (AAOIFI).

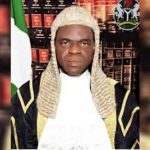

The decision of the leadership of Financial Reporting Council, FRC under Dr Rabiu Onaolapo Olowo to divest and align statutorily, with FRC’s responsibility capable of setting , monitoring and enforcing financial standards in the country.

The interest free transactions Islamic Finance Services, IFS, is capable of advancing rapid growth in Islamic Banking Sukuk Issuances , Takaful insurance,as well as non -interest capital market products which “,necessitates consistent and globally comparable financial reporting”.

With the dynamic nature of Islamic Financial system, the decision and wisdom of the handlers of Financial Reporting Council FRC , under the purview of Dr Rabiu Olowo as the Executive Secretary and Chief Executive officer envisaged financial inclusion, huge infrastructure financing, ethical investments.

No doubt in Nigeria, with the new order and administrative wisdom of FRC management, Sukuk among many others had granted the country with series of non interest loan to finance roads projects across the country that has addressed infrastructure decay in the country.

The introduction and growth of Islamic Financial Services,IFS guaranteed the obligations for regulators like Financial Reporting Council, FRC, with it’s reliability and globally comparable Islamic Financial Services, IFS.

The new wave of Banking and adoption of Standards like AAOIFI would complement the existing IFRS practices, providing a reliable framework for contracts and financial instruments applicable in Islamic Finance.

Under President Bola Ahmed Tinubu’s administration and Renewed Hope Agenda gearing for infrastructure renaissance, rejuvenation and introduction of more development in all areas , the Financial Reporting Council, FRC had broken the yoke and obligations of financial commitment of government from National trickled down to States and Local Governments.

“He emphasized that Nigeria’s financial system is evolving, and our regulatory framework must evolve with it. ”

“The inclusion of AAOIFI standards into our national framework is not just a regulatory necessity, it is a strategic imperative for building trust, enhancing transparency, and ensuring that Islamic Finance continues to contribute meaningfully to economic growth and financial inclusion.” Olowo stated.

With the support and endorsement of the present administration under President Bola Ahmed Tinubu’s administration and Renewed Hope Agenda that described Islamic finance as emergence as a powerful ally, because the system framework is rooted in ethics, fairness and shared prosperity.

Also the contributions and further endorsement of financial experts and policy makers in the industry like the former Central Bank Governor , His Royal Highness, Muhammadu Sanusi 11, 14th Emir of Kano and former Central Bank Governor who expressed supports and pleasure at the industry’s growth, noting:

“We are beginning to see geometric growth in the number of banks that have been licenced and the number that have applied for licences.”

“He further stated: Islamic financing in its core invests in real assets like roads, power plants, water and digital networks. In Nigeria for instance, if we have constant access to electricity it will easily give a $1 trillion economy.”

He concluded: Islamic financing fits perfectly to infrastructure finance than any other institution because it is built on truth, where every financing is tied to a real tangible asset that creates jobs and long-time value. ”

Aside conventional Banking, The Financial Reporting Council, FRC had explored the Islamic Financial Services, IFS, through “Islamic Banking” to galvanize the needed funding of infrastructure deficits prevalent over the years in Nigeria.

Written BY ABUBAKAR YUSUF on yus.abubakar3@gmail.com.

(Democracy Newsline Newspaper, December 12th 2025)