ANALYSIS & FEATURE

Nigeria’s ₦58.4 Trillion Budget: Ambition, Burden, and the Question of the Nigerian Masses.

By Bala Salihu Dawakin Kudu

December 20, 2025.

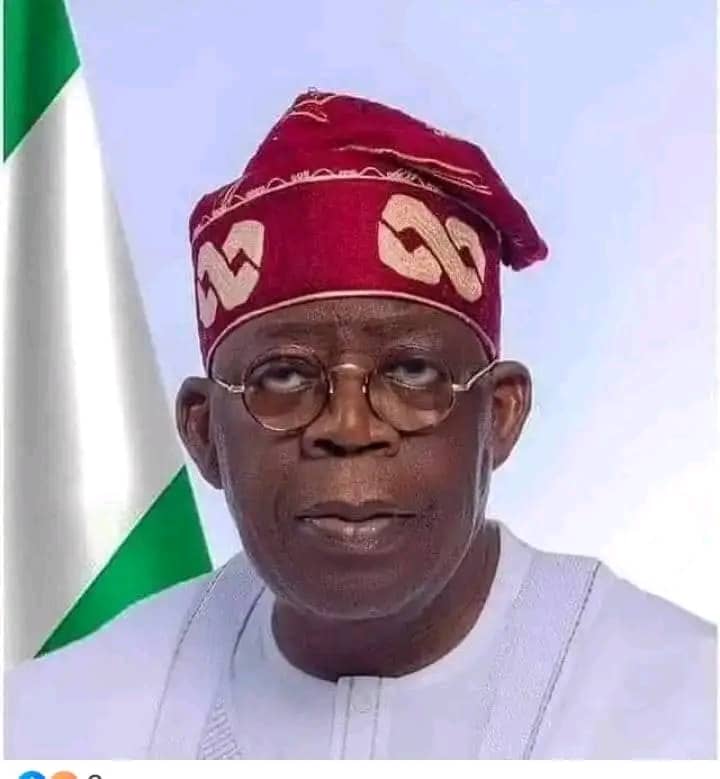

President Bola Ahmed Tinubu’s presentation of the ₦58.4 trillion 2026 Appropriation Bill has been framed as a turning point in Nigeria’s economic story—a “Budget of Consolidation, Renewed Resilience, and Shared Prosperity.”

On paper, it is historic in size, ambitious in intent, and bold in rhetoric. Yet beneath the optimism lies a series of deep structural, fiscal, and social challenges that raise critical questions about implementation feasibility, fiscal sustainability, and real benefits to ordinary Nigerians.

This budget, while visionary, exposes the widening gap between policy ambition and lived economic reality.

1. A Budget Built on Fragile Assumptions.

At the heart of the 2026 budget are macroeconomic assumptions that remain highly vulnerable to shocks:

Oil benchmark: $68 per barrel.

Exchange rate: ₦1,400/$

Nigeria’s heavy dependence on oil revenue remains unchanged, despite years of reform rhetoric.

Oil theft, production shortfalls, pipeline vandalism, and global energy transition risks continue to undermine revenue projections. Any dip in oil prices or output will instantly widen the already massive deficit, forcing the government into more borrowing.

The exchange rate assumption also appears optimistic in a volatile forex environment where inflationary pressure and weak exports persist. A further naira depreciation would significantly increase the cost of debt servicing and imports, worsening inflation for ordinary citizens.

2. A Dangerous Deficit and the Debt Trap.

The most alarming figure in the 2026 budget is the ₦23.45 trillion deficit, representing nearly 40% of total spending. This raises three major concerns:

A. Rising Debt Servicing Burden.

Nigeria already spends a large portion of its revenue servicing debt. With projected revenue at ₦34.33 trillion, the deficit implies heavy borrowing, meaning future budgets will be increasingly consumed by debt repayment rather than development.

b. Crowding Out Social Spending.

As debt servicing grows, spending on education, healthcare, and social protection risks being squeezed, directly hurting the poor and middle class.

c. Intergenerational Burden.

This borrowing trajectory effectively shifts today’s fiscal problems to future generations, contradicting the idea of “shared prosperity.”

3. Implementation: Nigeria’s Weakest Link.

Historically, Nigeria’s greatest budget problem has not been design—but implementation.

Key Implementation Challenges Include:

Poor project execution due to weak oversight

Delayed budget passage and late releases of funds

Inflated contracts and corruption risks.

Capacity gaps in ministries, departments, and agencies (MDAs).

While the President’s pledge to clear outstanding capital liabilities and adopt a unified budget framework is commendable, it remains aspirational unless matched with strict enforcement, transparency, and consequences for non-performance.

Past budgets with large capital allocations have delivered minimal impact on roads, power, housing, and water, raising doubts about whether ₦26.8 trillion in capital spending will translate into visible development.

4. Security Spending: Necessary but Economically Draining.

The ₦5.41 trillion allocation to security reflects Nigeria’s dire safety situation. However, it also highlights a troubling reality:

Nigeria is spending enormous sums treating symptoms rather than addressing root causes.

Despite years of increased security budgets:

Terrorism persists

Banditry expands

Farmer-herder conflicts remain unresolved

Without parallel investments in jobs, rural development, education, and justice, security spending risks becoming a bottomless pit, draining resources without delivering lasting peace.

5. The Nigerian Masses: Left on the Margins

Despite the “shared prosperity” branding, the budget offers limited direct relief to ordinary Nigerians facing:

High food prices

Rising transport costs

Unemployment and underemployment

Weak purchasing power

Key Gaps Affecting the Masses:

No clear wage adjustment strategy to match inflation

Inadequate social safety nets relative to the scale of poverty.

Education and health allocations remain low when adjusted for population growth and inflation

Small businesses and informal sector support is vague and underfunded

For millions of Nigerians, macroeconomic “stability” has not translated into lower living costs or better livelihoods.

6. Tax Reforms: Revenue Growth or Added Burden?.

The introduction of new National Tax Acts aims to expand revenue, but there is a real risk that tax pressure will fall disproportionately on the already struggling middle and lower classes, while elite tax evasion remains weakly addressed.

Without strong enforcement and equity, tax reforms could:

Reduce disposable income

Slow consumer spending

Deepen public resentment.

7. A Budget of Hope or a Test of Credibility?

The 2026 budget is undeniably bold. It signals confidence, reform continuity, and political resolve. However, its success hinges on factors Nigeria has historically struggled with:

Discipline in spending

Transparency in execution

Political will to fight corruption

Real prioritization of human welfare

Without these, the budget risks becoming another large financial document with limited social impact.

CONCLUSION:

Between Promise and Reality

President Tinubu’s ₦58.4 trillion budget represents a defining moment—but also a defining risk. It is a budget heavy with expectations, borrowing, and assumptions, yet light on immediate relief for the masses.

For Nigerians, the true test will not be the size of the budget, but:

Whether food becomes affordable.

Whether jobs are created.

Whether security improves

Whether public services actually work.

Until those outcomes are felt at the grassroots, the promise of “shared prosperity” will remain a slogan rather than a lived experience.

Write by Bala Salihu Dawakin Kudu Berue Chief North-West can be reach 08060017934.

(Democracy Newsline Newspaper, December 20th 2025)