Beyond the Balance Sheet: Understanding Real Power in African Wealth

By Dr. Aiyeku Olufemi Samuel

Governance Analyst | Development Economist | Strategic Development Advocate

In today’s hyper-digital financial ecosystem, the narrative of wealth is often dominated by high-flying tech billionaires and stock valuations that fluctuate with the stroke of a tweet. But what truly defines power, particularly in the African context? Is it the volatile digits on a Bloomberg screen—or the grounded influence of brick-and-mortar empires that build nations?

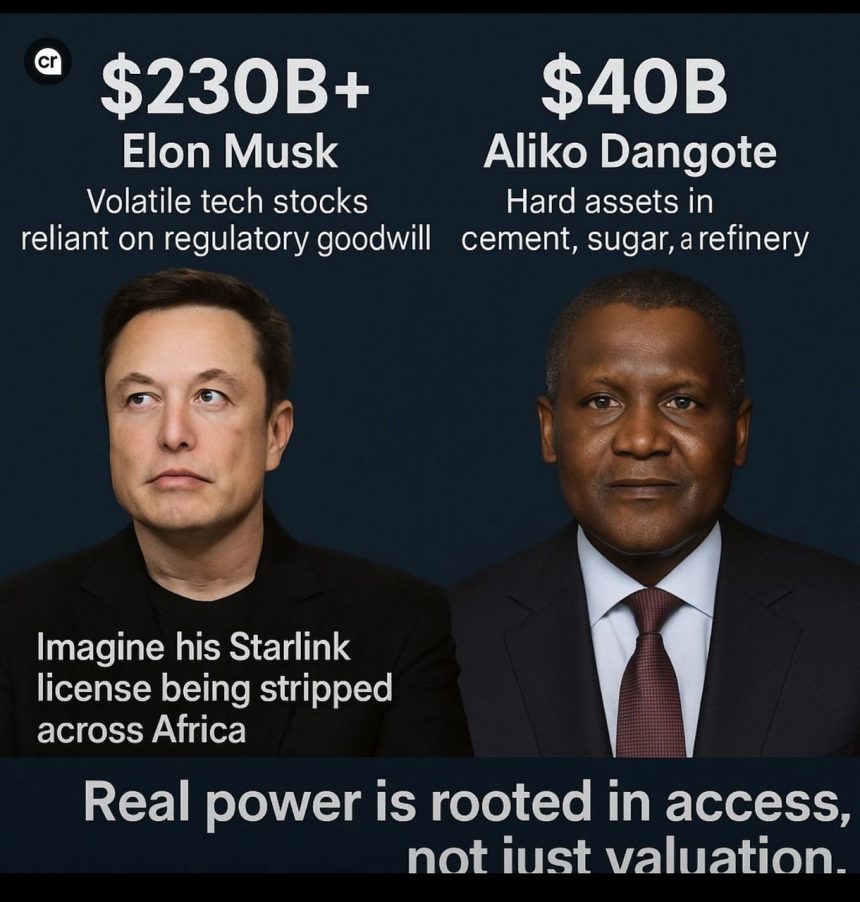

Let’s take two case studies. Elon Musk—arguably the world’s most famous entrepreneur—commands a net worth of over $230 billion, largely tied to the stock performance of companies like Tesla, SpaceX and the highly futuristic Starlink. But this valuation is highly volatile. A regulatory clampdown, policy reversal, or market mood shift can wipe out tens of billions in hours. For instance, if African governments were to revoke Starlink’s licenses tomorrow, vast parts of that paper wealth would evaporate—leaving behind no tangible fallback in the form of factories, natural assets, or on-ground infrastructure.

Contrast that with Aliko Dangote, Africa’s richest industrialist, whose wealth is fundamentally grounded in physical capital and national economic relevance. With over $40 billion in tangible assets—from the sprawling Dangote Refinery to cement plants, sugar mills, and fertiliser complexes—he has built a resilient empire that does not rise or fall on tech hype cycles. He holds more than $17 billion in liquidity, making him one of Africa’s most financially agile power brokers. His supply chains stretch across borders. His factories employ thousands. His products meet essential needs. His influence isn’t just economic—it’s strategic.

What this tells us is simple yet profound: In Africa, real wealth must be both sovereign and strategic. It must rest not only on valuation, but on value—on the ability to provide employment, control supply chains, and influence national policy outcomes. Paper wealth, no matter how glittering, is ultimately subject to foreign policy shifts, algorithmic market behaviour, and investor sentiment. But tangible power—built through physical infrastructure, agro-industrial capacity, and energy control—is insulated by domestic relevance and irreplaceable demand.

“He who controls the factory controls the future. He who owns the stock may only control a moment.”

— Anonymous African Economist

There is a lesson here for Africa’s rising class of digital entrepreneurs, policymakers, and youth dreaming of tech unicorns: Build infrastructure, not just interfaces. Create industries, not just apps. Ground your wealth in sovereignty.

Strategic Recommendations:

Governments must incentivize capital flows into manufacturing, agro-processing, and logistics over speculative fintech ventures.

Young entrepreneurs should adopt hybrid models that pair technology with physical production and supply chain solutions.

investment policies must prioritize asset-backed ventures over startup valuation bubbles, especially in sectors critical to national development.

In conclusion, wealth without structure is vulnerable. Power without place is illusion. Let Africa not chase valuations; let it build value. As global economies become more unstable, it is only grounded capital that will weather the storms and truly shape the future.